The sheer scale of the UK’s car finance debt is a growing concern as the country’s cost of living crisis puts household budgets under unprecedented pressure.

Car finance debt has been accelerating far beyond wage increases for the last 13 years, according to extensive analysis of publicly available data conducted by The Car Expert, as car manufacturers and dealers have encouraged buyers to borrow more and more money using PCP car finance.

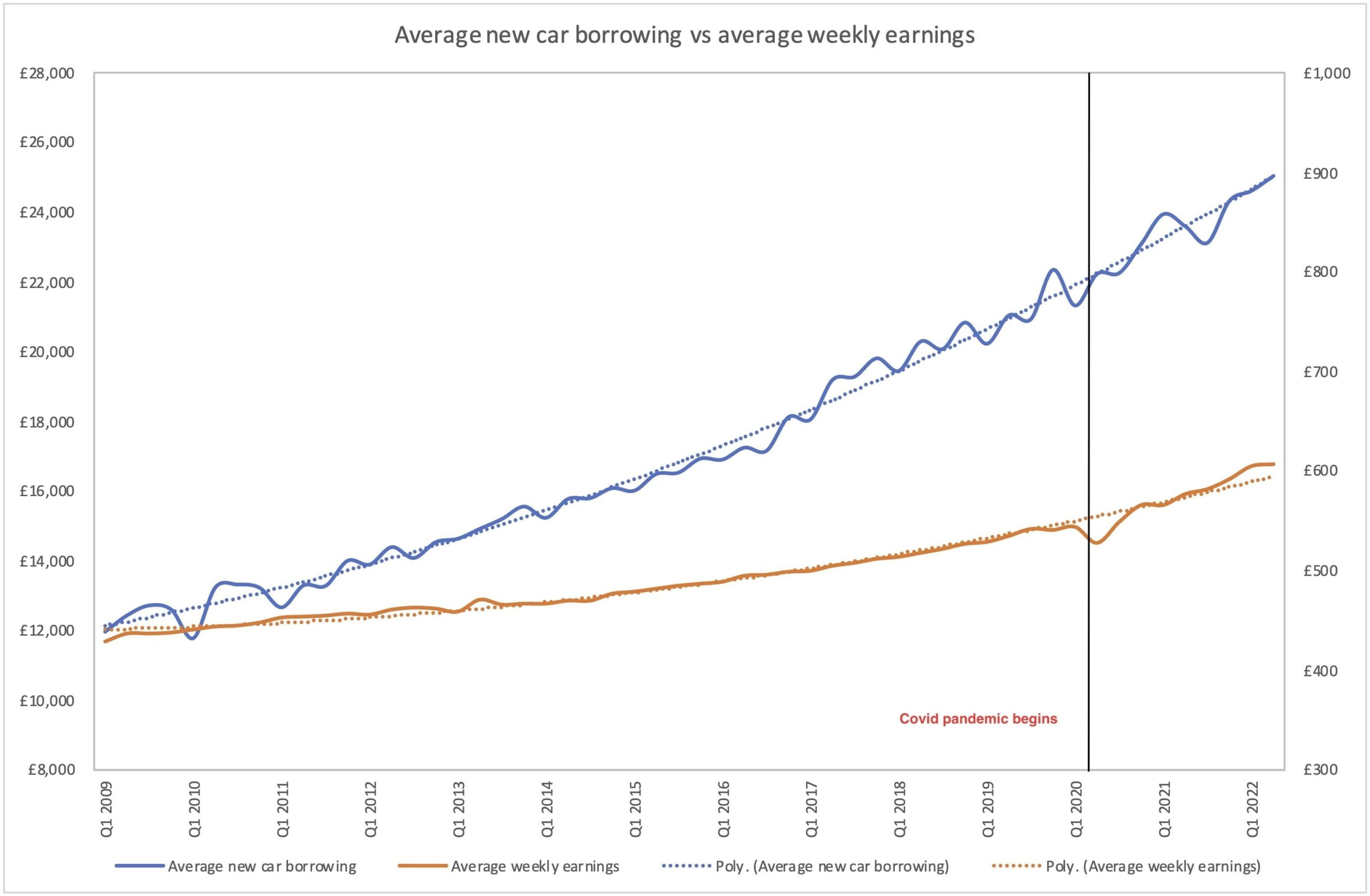

From 2009 until the middle of 2022, the average amount of money borrowed on a new car has more than doubled, from £11,964 to £25,039[1]. The total amount borrowed on new cars in the UK is almost £17.5 billion a year – and it was pushing £20 billion a year before the Covid-19 pandemic[2].

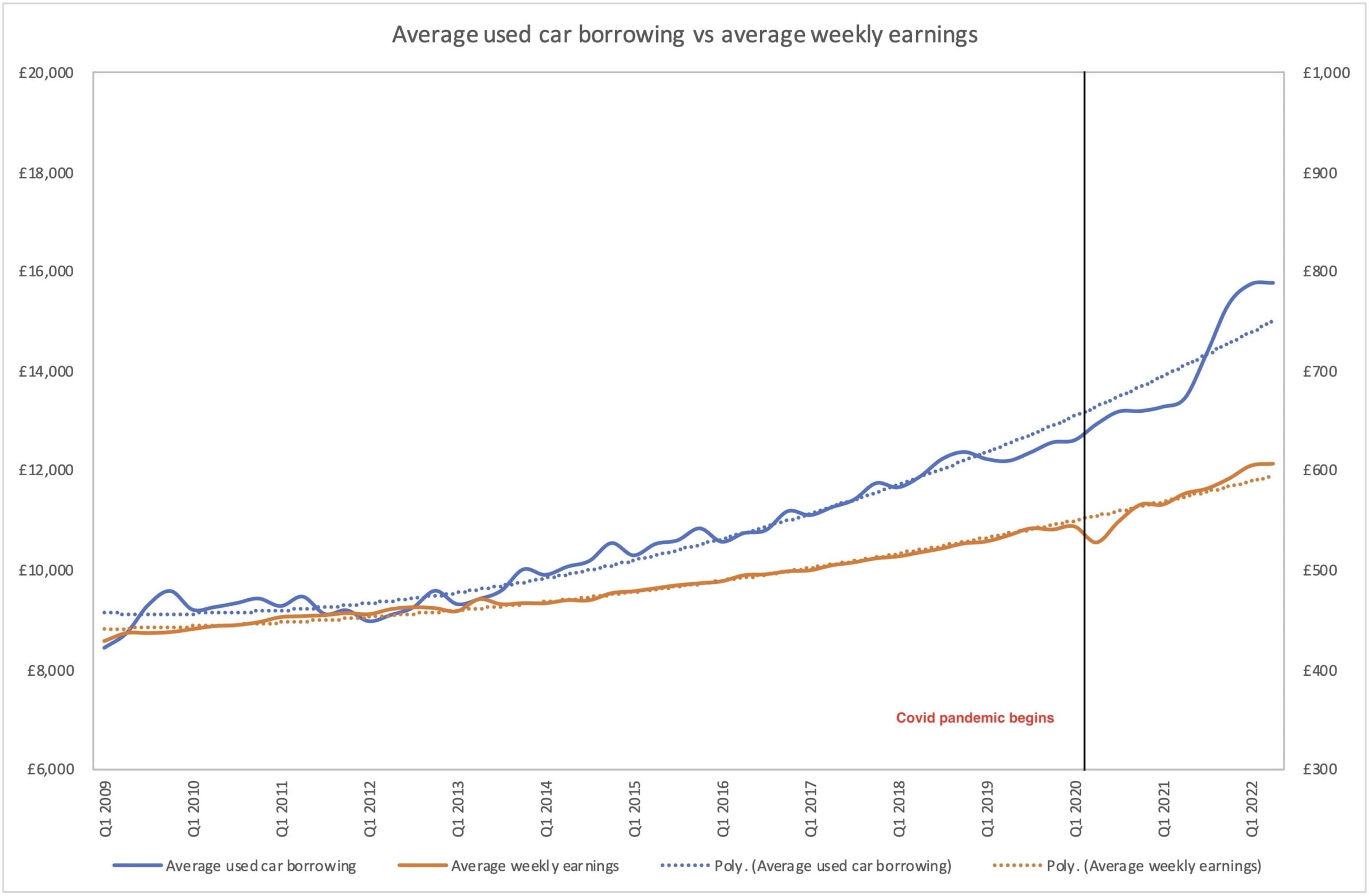

Similarly, the average amount borrowed on a used car has increased by 87% over the same period, from £8,444 to £15,771[3]. The total amount borrowed on used cars in the UK over the last 12 months (July 2021 to June 2022) is more than £22 billion, with year-on-year growth increasing every month[4].

In comparison, average weekly earnings have only increased by 33% over the same period[5], and growth in real-world disposable incomes have been even less.

We have detailed tables and charts at the end of this article that look at all these numbers in more detail.

With household budgets under unprecedented pressure from the current cost of living crisis, there is a real risk that a lot of people could simply find themselves in serious financial trouble if they can no longer afford to make their monthly car finance payments. If your household bills have gone up by hundreds of pounds a month, finding several hundred to service your car finance debt and pay your car’s running costs (fuel, insurance, road tax) each month is getting even harder.

Why is car finance so important?

The car industry is entirely reliant on customers buying cars they don’t need with money they don’t have. If we only bought the cars we could afford with the savings we had available, there wouldn’t be a massive global automotive industry and cars would remain playthings for the very wealthy.

The current risk is that car finance debt has grown so much over the last decade that increasing financial pressures on a large number of borrowers could lead to widespread defaulting, which could collapse the whole house of cards. It may sound unlikely, but there appears to be no desire by anyone to slow the accelerating growth in car finance debt.

The Covid pandemic provided a warning to lenders that many of their customers were overloaded with debt, but the last year has seen average borrowing accelerate even more compared to pre-pandemic levels, so that lesson has clearly been ignored.

Why has car finance debt increased so dramatically?

There has been a sea change in how buyers finance new and used cars over the last decade and a half.

Back in 2009, only about 40% of privately-purchased new cars were financed at point of sale[6], using finance brokered by the car dealership. Most borrowing was obtained from other sources, like personal loans from your bank.

Dealer-sourced finance from dedicated car finance companies has grown to about 93% of all private new car sales in 2022[7], meaning that nearly every consumer new car purchased is tied into a finance contract arranged by the dealership.

Used cars have seen similar growth[8], although dealer finance is a much smaller segment of overall used car sales (used car sales cover everything from £100 junk vehicles to near-new vehicles like demonstrators or pre-registered cars).

Car finance brokered by the dealership is usually in the form of a personal contract purchase (PCP), which is far and away the most dominant type of finance agreement now used by consumers to buy a new or used car.

With a PCP, car buyers are able to borrow much more money for a given monthly payment. We explain this in much more detail here.

The concern is that the monthly repayments don’t go anywhere near paying off the full value of the debt, so that if a customer can no longer afford the monthly payments, the amount of car finance debt they are carrying is much higher. Even if they can sell the car (which is not always an option), chances are that it won’t go anywhere near paying off the outstanding debt, leaving the customer with thousands of pounds still to pay off and no way of paying it.

Unless there’s another sea change, this growth in car finance debt will only accelerate as we transition from petrol and diesel cars to electric vehicles. EVs are typically a lot more expensive than their fossil-fuel equivalents, which means borrowing even more money for a comparable car.

But what about the Guaranteed Future Value?

One of the key features of PCP car finance is that the finance company guarantees the value of the car will be worth at least the final balloon payment at the end of the agreement, which is called the guaranteed (minimum) future value (GFV or GMFV). This allows you to give the car back to the finance company at the end of the agreement with nothing further to pay.

However, the GFV only kicks in at the end of the agreement. So if you’re only two years into a four-year agreement, you will almost certainly have a large amount of negative equity, meaning your debt is much greater than your car is worth, and there’s nothing to protect you.

But what about voluntary termination?

Voluntary termination (VT) is one of the most misunderstood aspects of PCP car finance, and in reality it doesn’t offer you all that much protection. It’s more useful if you have an old-fashioned hire purchase (HP) or a conditional sale, but both of these are pretty rare today.

With a voluntary termination, you have the right to terminate the agreement by giving the car back to the finance company paying back half of the Total Amount Payable.

There’s a lot of specific information contained within that one sentence. The Total Amount Payable is a very specific number, which includes your up-front deposit, all your monthly payments, the balloon amount and any additional fees. On a £20k car, the Total Amount Payable could easily be £24k or more.

If you have already paid half the Total Amount Payable, you can simply give the car back with nothing further to pay. If you haven’t reached it (because you’re still too early into your agreement), you can still VT but you have to pay whatever is still needed to reach the halfway point.

The problem is that, if your PCP agreement runs through its normal course, you won’t reach the VT point until right near the end of the agreement when you’d be able to hand it back anyway. So, at best, it offers some protection in the last few months of your agreement. For the majority of the three-to-four years of your contract, you’re not really protected at all.

What happens if I can’t afford my car finance payments?

If you default on your car finance, things can turn ugly very quickly. So the best course of action is to engage with your car finance provider (not the dealer where you bought the car) as soon as you’re starting to struggle. Doing nothing and waiting for collections agents to turn up on your doorstep will only make things much worse.

Finance companies are obliged to act with consideration for financial hardship, but that doesn’t mean they’re just going to cancel your loan and allow you to walk away. It’s all about helping you work through your financial obligations to pay off your debts rather than cancelling them.

Depending on your situation, you may be offered an extension to your agreement with lower monthly payments, a reduction in interest charged on the borrowing, a payment holiday, or other options to help you out.

What happens if millions of people can’t afford their finance payments?

If large numbers of consumers can’t afford to service their car finance debt, the car finance companies and potentially even the car manufacturers (who own a lot of the finance companies) will be at risk.

During the early days of the Covid-19 pandemic, the Financial Conduct Authority was forced to rush through new rules for lenders to protect borrowers. There was genuine concern that millions of customers could suddenly default on their car finance agreements, which could have brought down the entire sector and crippled the car industry.

While it’s certainly unlikely that we’re likely to see large car companies collapsing over car finance defaults like we did with banks during the mortgage crisis of more than a decade ago, it could materially affect their financial positions, which would impact how much money they can invest in new vehicles and new technologies.

The car industry is currently spending huge amounts of money on new electric vehicles that they will want us all to buy in coming years, so it’s crucial for them that we can all continue to afford to buy their ever-more expensive cars.

How can we improve this?

As much as no-one in the car industry wants to hear it, it’s probably long past time to start introducing tougher limits on how much consumers can borrow for a car, rather than prioritising monthly payments.

Instead of the main focus being on whether a customer can afford their monthly payments right now, there should be much greater scrutiny on overall car finance debt since that’s a critical factor if things go wrong during an agreement.

PCP finance is sold on the basis that it makes a given car more affordable by reducing monthly payments. Yet it’s actually used to increase debt levels for the same monthly payments, so it’s simply being used to bring more expensive cars into reach for more people – which works fine as long as the world continues to run smoothly.

A typical car finance agreement now runs for about four years, and a lot can happen in that time. Since 2018, the UK has endured three prime ministers, a Brexit process that has not gone smoothly, a devastating global pandemic, ongoing industrial and economic fallout from said pandemic, and now a global economy severely impacted by Russia invading Ukraine, with inflation and the cost of living skyrocketing. All of these things have impacted on household finances – what will happen in the next four years?

The other problem is that cars are getting more and more expensive, especially as we move from fossil fuel vehicles to electric vehicles. Limiting overall borrowing could block customers from being able to buy electric cars just as the government and the car industry are trying to encourage us all to do so. Current finance products may not be fit for purpose for EVs, so we may need to look for alternatives to PCP finance.

Having just about survived Covid, will the latest cost-of-living crisis finally burst the car finance bubble that has been propping up the car industry for the last decade?

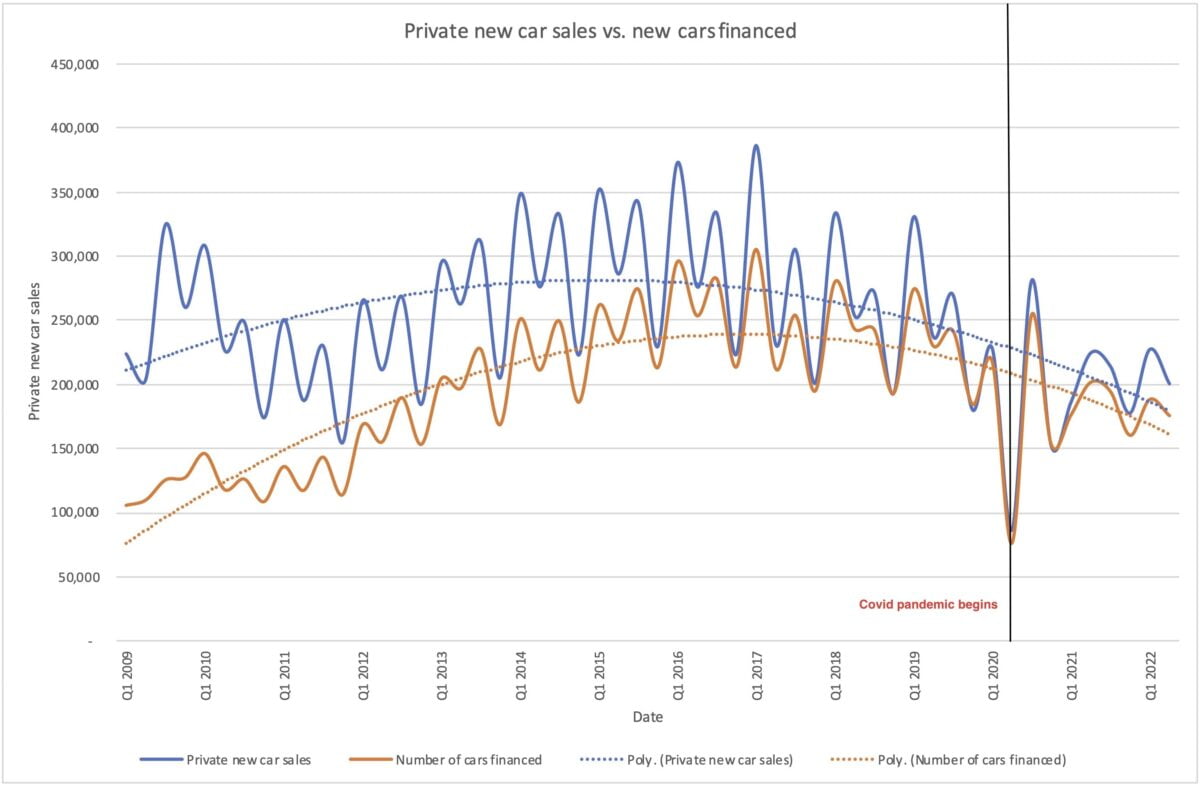

Appendix 1: Private new car sales and financing, 2009 to 2022

The table above shows the change in private (consumer) new car sales from January 2009 to June 2022, the number of new cars being financed, the total amount borrowed on new cars and the average amount borrowed per new car.

The first chart illustrates the number of cars sold vs the number of new car finance agreements. Back in 2009, only about 40% of new cars were financed through the dealership. Today, that figure is more than 90%. Although sales fluctuate up and down each quarter based on the biannual number plate changes, the proportion of cars financed via dealer-sourced finance increases steadily over the decade.

As you can see, private new car sales peaked in 2015/2016[9], and have been declining ever since. Obviously, Covid-19 made a huge impact in 2020 with knock-on effects that are still being felt today, but sales had already been declining for three years before that.

Borrowing, on the other hand, has increased steadily each year. At the start of 2009, which is as far back as the publicly published data goes, average new car borrowing was less than £12,000. By June 2022, it stood at more than £25,000.

The second chart illustrates this clearly, showing how the growth in average borrowing on new cars has streaked away from increases in average earnings.

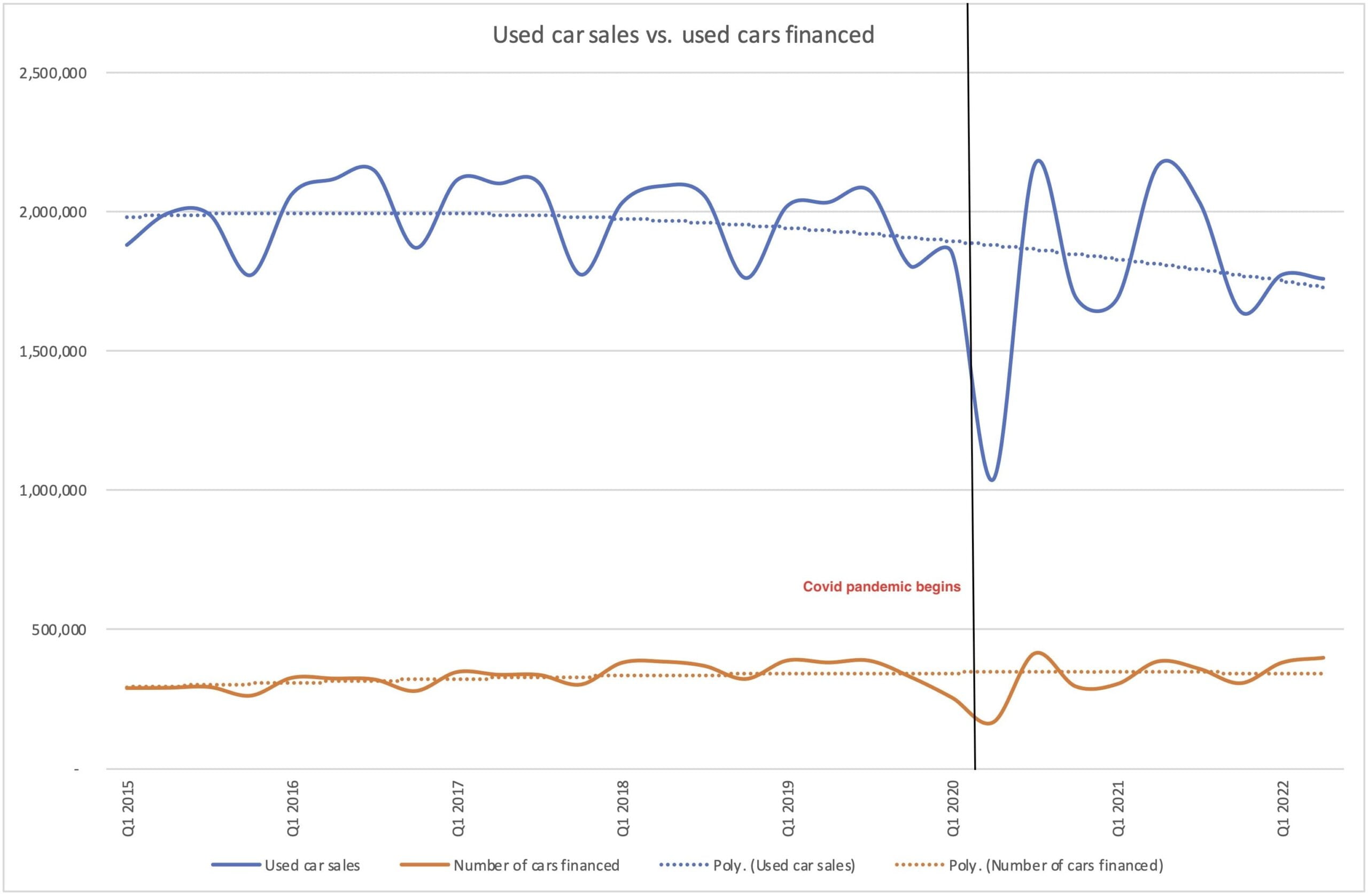

Appendix 2: Private used car sales and financing, 2009 to 2022

Looking at used car data, we can see that that although many more used cars than new cars are sold each year, a much lower percentage of them is financed. This is not surprising, as millions of used cars change hands for low values – a few hundred to a few thousand pounds – that are not usually viable options for car financing.

The first chart illustrates the number of used cars sold vs the nuber of private used car finance agreements. Unfortunately, the scale of the chart means it’s difficult to see the levels of change going on. We also only have used car sales data back to 2015[10], rather than 2009, as that’s how long the SMMT has been publishing quarterly used car sales reports.

You can see that sales still fluctuate throughout the year, roughly in line with the new car market but with far less variation. Post-Covid data shows enormous fluctuations in sales numbers throughout 2020 and 2021 as a result of multiple lockdowns across the UK.

What is still evident, however, is the steady growth of average car finance debt since 2009. This has accelerated since the Covid pandemic and especially since late 2021, largely thanks to severe shortages in new car stock forcing would-be new car buyers to look for used car options instead.

It’s also important to remember that used car finance agreements usually charge a lot more interest than new car finance agreements, so a larger component of a customer’s car finance debt is interest rather than capital. This increases the precariousness of their financial position if circumstances turn against them and they find themselves in financial hardship, as even if they can sell their car (which is not a given), it almost certainly won’t cover the debt still owed.

Since 2009, average used car borrowing has increased by 87% from about £8,400 to almost £15,800.

Appendix 3: Average weekly earnings, 2009 to 2022

Finally, we have average weekly earnings from January 2009 to June 2022. These have increased steadily over the last 13 years, but at a much lower rate than borrowing has grown. And when you take into account inflation and increased costs of living over the same time, disposable income has hardly increased at all.

Since 2009, average weekly earnings have increased by about 33%, from £429 to £607. By comparison, average new car borrowing has increased by more than 100% and used car borrowing has increased by 87%.

Data sources

1, 2, 3, 4, 6, 7, 8 Finance & Leasing Association data from January 2009 to June 2022

5 Office for National Statistics data from January 2009 to June 2022

9, 10 Society of Motor Manufacturers and Traders (SMMT) new car registration data from January 2009 to June 2022