Say-Cheese/iStock by way of Getty Visuals

Micron Technological innovation (NASDAQ:MU) shares fell Friday, June 3 as investment decision organization Piper Sandler downgraded the memory chipmaker, citing its “outsized exposure” to shopper electronics.

With Micron in the highlight, other bellwether semiconductor firms also ended up negatively impacted. Intel (INTC) was off by 2.6% while Nvidia (NVDA) was down by 4.5%, Qualcomm (QCOM) shares fell by 3.5% and Innovative Micro Products (AMD) dropped 3%.

According to the Tech Be aware in Searching for Alpha:

- Micron is also not as exposed to the automotive industry, which Kumar mentioned activities like climbing prices, a slowing macro and the risk of excess inventory may perhaps be a problem.

- Kumar pointed out that Micron’s exposure of larger than 50% to consumer marketplaces is bigger than quite a few other semiconductor corporations, and with some weakness in the cell and Computer marketplaces, it can be likely there could be “added tension on the organization.”

My Investigation

Potentially it is really in the definitions of the Piper Sandler database utilized to downgrade Micron. But my investigation displays appreciably distinctive metrics, which is demonstrated under in this write-up.

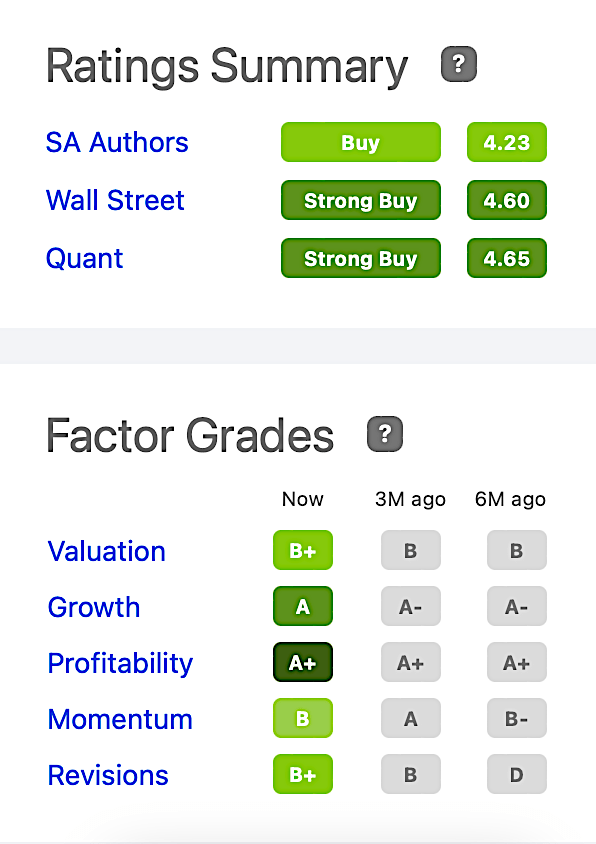

Automotive Memory

Revealed in Chart 1, Micron’s share of the total Automotive Memory sector of $3,700 million was 55.% in 2021, up marginally from 53.9% in 2020, in accordance to The Information Network’s report entitled “Scorching ICs: A Marketplace Investigation of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

Chart 1

The Info Community

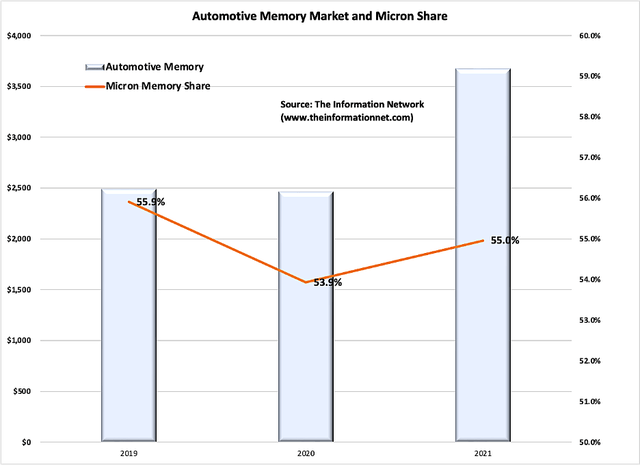

Automotive Semiconductor

Chart 2 shows that Micron’s share of the complete Automotive Semiconductor Market place of $51,600 million was 3.9%, up a bit from 3.4% in 2020.

Chart 2

The Information Network

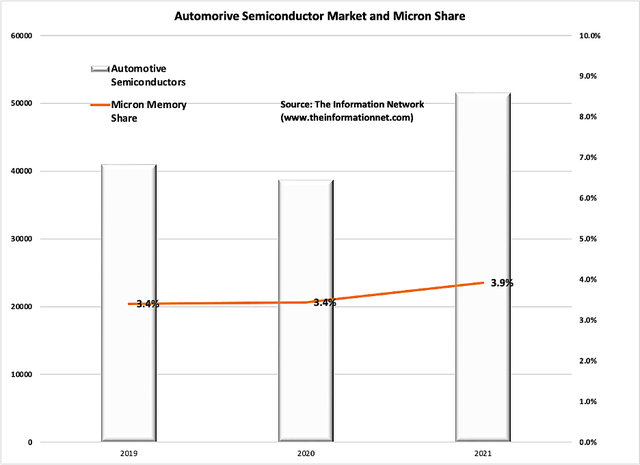

Customer Semiconductor

Chart 3 demonstrates Micron’s share of the international Customer Semiconductor current market of $46,800 million was 2.5% in 2021, down somewhat from 2.8% in 2020.

Observe that my assessment of the “Purchaser” phase is primarily based on Field Consortia “Semiconductor Marketplace Affiliation” definitions.

Chart 3

The Info Network

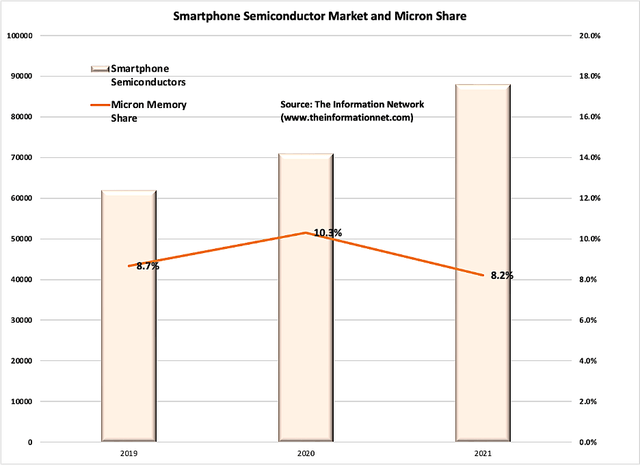

Smartphone Semiconductor

Chart 4 shows Micron’s share of the global Smartphone Semiconductor current market of $88,100 million was 8.2% in 2021, down from 10.3% in 2020.

Chart 4

The Info Network

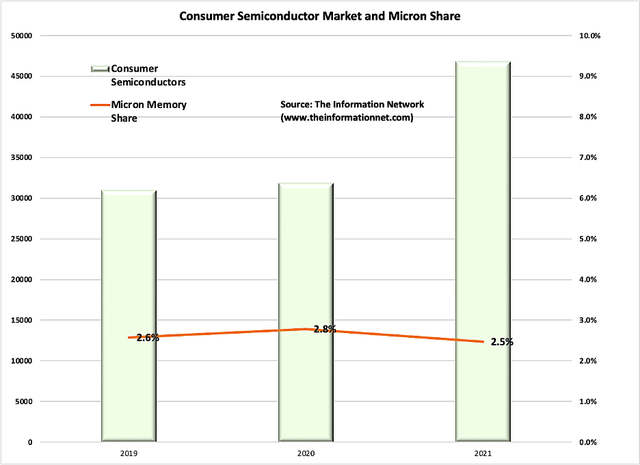

Trader Takeaway

The Piper Sandler evaluation states that Micron’s exposure was better than 50% of buyer marketplaces. My assessment demonstrates that it is just 2.5% of the $46 billion consumer semiconductor (Chart 3) and 8% of the $88 billion smartphone semiconductor markets (Chart 4). These shares are significantly under the 50% share claimed by Piper Sandler.

In the Automotive semiconductor market, Piper Sandler experiences that Micron is also not as exposed to the automotive marketplace. In my evaluation, Micron has a 55% share of the $3.7 billion market (Chart 1), which in my impression, is substantially much more than “not as uncovered.” Certainly, if we contemplate the all round Automotive Semiconductor market, Micron does have just a 3.9% share of the $52 billion marketplace.

Investors have to contemplate that Micron’s automotive share of complete revenues is 7% in contrast to semiconductor suppliers that focus in the automotive industry, this kind of as NXP Semiconductors (NXPI) with a 47% publicity, or Infine

on with a 46% exposure.

I rate Micron a purchase. My examination also correlates with Looking for Alpha’s Ratings and Issue Grades demonstrated in Chart 5.

Chart 5

Trying to find Alpha