jiefeng jiang/iStock via Getty Images

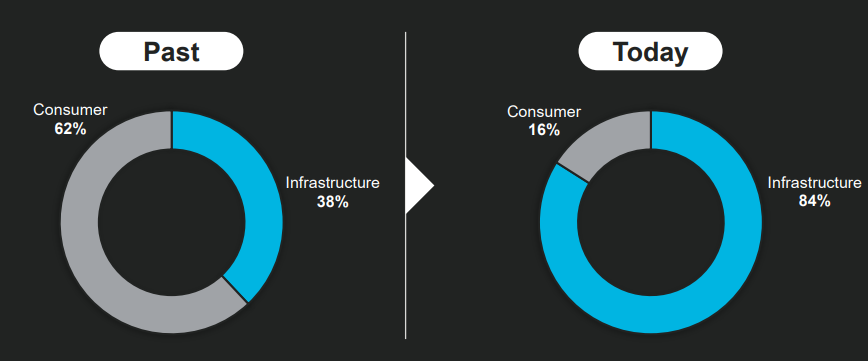

I invest in several secular growth trends, including 5G and Internet of Things, and decided to take a look at Marvell Technology (NASDAQ:MRVL) as an alternative to other stocks that I own in this investing theme, namely Skyworks Solutions (SWKS). I like the fact that it is a business more geared to infrastructure rather than the consumer market, but its financial profile needs to show improvement in the coming years.

Business Overview

Marvell is a technology company offering infrastructure semiconductor solutions, to data centers and other industries. Its industry is characterized by strong competition, with its main competitors being Broadcom (AVGO) and Qualcomm (QCOM), as well as others. It currently has a market capitalization of about $44 billion, being therefore a mid-sized company by this measure compared to other players in its industry, and trades on the NASDAQ.

Like many companies in the semiconductor industry, such as Advanced Micro Devices (AMD) or Qualcomm, Marvell is a fabless company, which means it outsources completely its production to third parties, namely to Taiwanese companies.

Its product portfolio includes multiple analog, mixed-signal and digital intellectual property components incorporating hardware, firmware and software technologies. The company’s business is separated between five end-markets, namely data center, carrier infrastructure, enterprise networking, consumer, and automotive/industrial. In its last fiscal year 2022, which ended on January 29, 2022, Marvell’s largest segment was the data center representing some 40% of its revenues, followed by enterprise networking (20% of revenues), carrier infrastructure (18% of revenues), consumer (16%), and automotive/industrial (6%).

This business diversification is a clear distinctive factor to other semiconductor companies that are suppliers to the wireless and wireline industries, which usually are vastly exposed to the consumer segment due to high reliance on mobile phones’ original equipment manufacturers, such as Apple (AAPL) or Samsung Electronics (OTC:SSNLF).

As I’ve discussed in a previous article on Qorvo (QRVO), one of the weakest factors of these companies is that they are much too exposed to a single customer (Apple) and moreover Apple’s strategy is to increase the share of in-house components in its products, being a long-term threat to its suppliers like Skyworks, Qorvo or Qualcomm. However, Marvell has transformed its business in recent years and is now much more exposed to infrastructure rather than the consumer market, a positive factor compared to its peers.

Business mix (Marvell)

Indeed, Marvell’s customer diversification is much better than most of its competitors, considering that only one distributor has had a weight of more than 10% of its revenue over the past three years, showing that Marvell is not overly reliant on Apple like many of its peers are. Geographically, some 80% of its revenue goes to customers located in Asia, which means that exposure to the domestic market is quite low.

This also means that Marvell has broad exposure to growth prospects from industry tailwinds beyond smartphones upgrades, of which 5G, the Internet of Things (IoT) connectivity or artificial intelligence (AI) are the main secular growth themes.

Growth Prospects

As I’ve discussed several times in previous articles, I invest mainly in secular growth companies in a few investing themes, namely semiconductors, electric vehicles, digital payments, 5G and big data. In the 5G/IoT/Big Data theme, I currently own Skyworks, Palantir (PLTR) and Microsoft (MSFT), while I’ve also covered Qualcomm and Broadcom in the past.

These secular growth trends are a strong tailwind for all companies in the semiconductor industry, as modern technology is constantly changing and new developments are constantly pushing for new applications and devices. The volume of data is expected to grow strongly over the coming years, through technological advances like 5G and cloud computing.

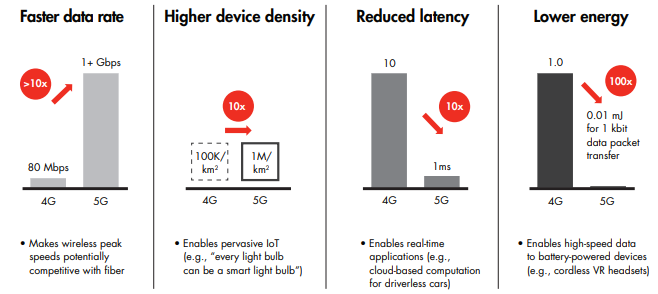

5G is the next-generation mobile network that should enable the connection of pretty much everything, including machines, objects, and devices increasing the total addressable market for wireless applications.

In a 5G network, wireless data can travel at real-world peak speeds of greater than 1 gigabit per second, which is 10 times faster than most 4G networks. This is also fast enough to compete with fiber-to-the-home wireline broadband, being therefore a huge technological development compared to 4G.

Latency is expected to drop significantly, by a factor of 10 compared to current technology. Latency is the time it takes for data to be transferred between its original source and its destination, measured in milliseconds. Internet latency and network latency affect satellite internet connections, cable internet connections, as well as some Wi-Fi connections.

5G (Bain)

With 5G, more smart devices can work together on the same network at the same time, which is key for the growth of the Internet of Things, both for people and businesses. For instance, the rise of artificial intelligence and IoT should become more intertwined, facilitated by 5G which offers gigabit speed, ultra-low latency and enhanced network capacity. Without 5G, this wouldn’t be possible or would put serious limitations to the growth of real-life applications of artificial intelligence.

Moreover, 5G is also very important for the development of two pioneering technologies, namely augmented reality/virtual reality (AR/VR) and autonomous driving. These are two technologies that may be some years away from mass-adoption, but have the potential to change our lives and rely on 5G networks to perform well in real-time.

Another area that I see closely related to 5G or IT is Big Data. The rise of more connected devices, powered by 5G, will create a vast amount of data, being a very important growth driver for the technology industry as a whole over the next decade. Big Data describes huge volumes of data that flood a business on a daily basis, coming from an ever-growing variety of sources. It typically describes data sets with sizes beyond the ability of traditional data processing software tools to capture, process and analyze in a timely fashion.

Another area that is strongly related to big data and data analytics is cloud computing. Cloud computing is the delivery of different services through the Internet. These resources include tools and applications like data storage, servers, databases, networking, and software. This is an industry with a very good growth history that is projected to reach annual revenues of about $150 billion in 2021 and grow to more than $200 billion next year. This compares to revenues of $101 billion in 2016, which implies a compounded annual growth rate of 12.9% during 2016-2022.

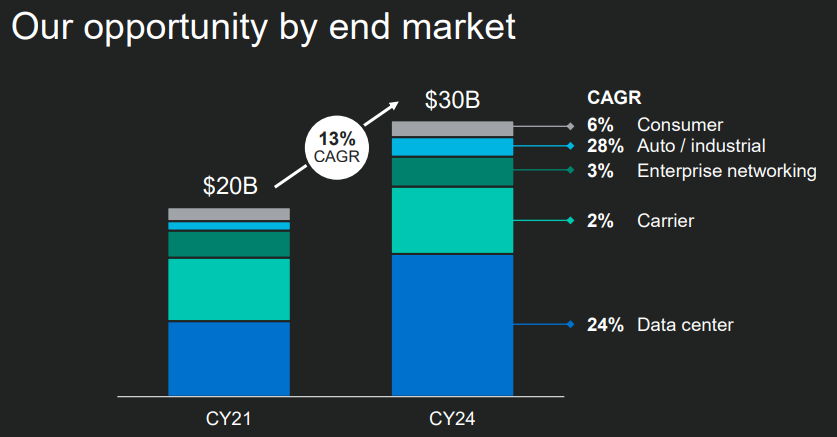

Marvell is one of the companies that is well-positioned to benefit from these secular growth trends, as the company has adapted its product portfolio for the expected growth of data centers and network infrastructure over the next decade, boding very well for the company’s business growth prospects in the medium to long term as the total addressable market of the company is expected to grow strongly over the next few years, especially in the data center end-market.

Market growth (Marvell)

Financial Overview

Regarding its financial performance, Marvell has a good growth history given that it has reported higher revenue over the past few years, both organically and through acquisitions, but its profitability needs improvement.

In its latest fiscal year (which ends in January) 2022, Marvell’s revenue amounted to $4.5 billion, an increase of 50% from the previous year, driven by higher selling prices (+20%) and higher volumes (+30%). Note that its growth was mainly organic, but these figures also include the acquisitions of Inphi and Innovium, both completed during the last fiscal year.

Nevertheless, Marvell enjoyed strong demand for its products across all its end-markets, with data center reporting revenue growth of 71% YoY, enterprise network was up by 43% YoY, and carrier infrastructure increased by 37% YoY. Its smaller end-markets of consumer (+22% YoY) and automotive/industrial (+112% YoY) were also quite strong.

Its gross margin decreased to 46.3% (compared to 50.1% in FY 2021), a decline that is justified by its acquisitions that led to integration costs, namely amortization of acquired intangible assets.

Like most technology companies, Marvell invests considerable in research & development (R&D), which amounted to more than $1.4 billion in FY 2022. As a percentage of revenues, this represented close to 32% of revenue, a very high level and much higher than for its closest peers. For instance, Broadcom is also a company that invests considerably on R&D, but its weight on revenues is about 20%, a much lower level than Marvell.

This is important because R&D is Marvell’s largest operating expense and a major reason why its operations are reporting losses. Indeed, other operating expenses were $955 million in FY 2022 (21.4% of revenues), leading to an operating loss of about $315 million in FY 2022, the third consecutive year of operating losses. Note that both R&D and SG&A also include stock-based compensation, which was $477 million (10.6% of revenue) in FY 2022, reported as part of R&D costs ($277 million) and SG&A ($173 million) expenses.

I think that it is important to invest in R&D to have some edge over competitors over the long term, but Marvell is a company that was founded more than 25 years ago and operates in a relatively mature industry. This means that as the business matures, its R&D budget should be ‘adapted’ to its revenue level and achieving operating profitability is increasingly an important factor for investors. While start-ups are allowed to invest aggressively in R&D in their first years, I don’t think that is the case for a company like Marvell and this is clearly a negative factor of its investment case.

Marvell’s bottom line was negative in FY 2022 ($421 million), compared to a loss of $277 million in the previous year. On the other hand, its cash flow generation was good because some expenses are non-cash (such as stock-based compensation and amortization of intangibles), and Marvell’s free cash flow amounted to $650 million (14.4% of revenue).

In the first quarter of fiscal year 2023, Marvell reported a good operating momentum with revenues up by 74% YoY to $1.45 billion, slightly above estimates, while gross margin improved to 51.9%. Data center was the segment that reported a higher revenue beat compared to estimates, as demand from customers in this industry remains quite strong. However, Marvell’s GAAP net income remained in the red, with the company reporting a loss of $448 million in the quarter.

For the next quarter, Marvell expects revenue to be around $1.51 billion and gross margin to be between 49.6%-51.9%, which means that operating momentum is expected to remain good in the next few months, despite the supply chain issues affecting the semiconductor industry, plus the lockdowns in China that are also affecting some of its suppliers.

Going forward, according to analysts’ estimates, Marvell should continue to report strong revenue growth considering that revenue should increase to about $6.18 billion in FY 2023, and grow to more than $11 billion by FY 2026. This implies an annual revenue increase of about 25% during this period, which is quite good compared to its closest peers, but not particularly surprising considering that its business is more exposed to infrastructure than its competitors.

Regarding its balance sheet, Marvell has increased significantly its financial leverage due to acq

uisitions in its last fiscal year, which led to a net debt position of about $4 billion and a net debt-to-EBITDA ratio of 3.3x at the end of the last quarter (based on GAAP). This is much higher than compared to its peers, which usually have very low financial leverage or even a net cash position. Even other players that have an above-average leverage usually don’t go further than a ratio of 2x, thus deleveraging should be one of Marvell’s key priorities.

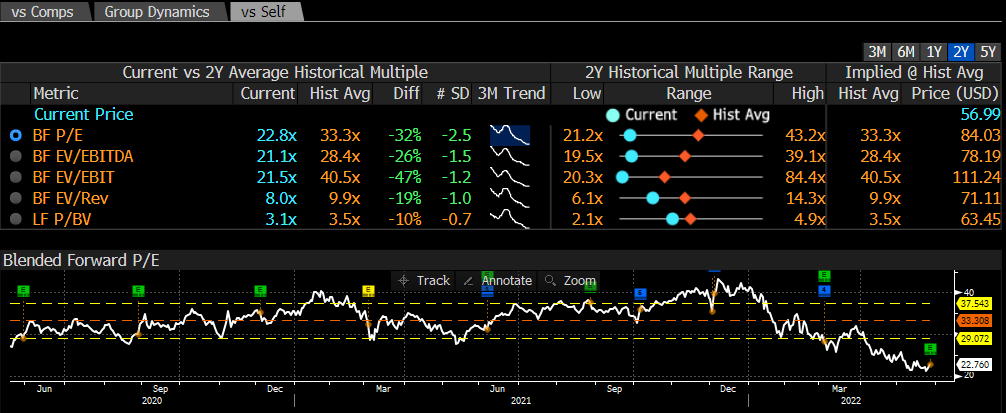

Regarding valuation, Marvell is currently trading at close to 8x forward revenues, while at its peak valuation back in November it was trading at about 14x forward revenue. Taking into account that is business is more exposed to infrastructure and has higher growth prospects than competitors, this seems to be a reasonable valuation and a better option than Broadcom for instance that is trading at 7.5x forward revenues.

EV/revenue (Bloomberg)

Conclusion

Marvell is exposed to some secular growth trends that should support its business over the coming years, especially data centers that should be a major growth engine. Its business mix is better than other companies in its industry due to a better customer diversification and much higher exposure to infrastructure, justifying a premium valuation.

However, personally, I don’t like its financial profile as the company is not profitable on a GAAP basis and its balance sheet leverage is much higher than its competitors, thus for me, I’ll avoid Marvell’s stock for the time being but may consider it for my portfolio if its profitability and leverage improve in the coming years.