jetcityimage

Dear readers,

Hyundai (OTCPK:HYMTF) is a not-uninteresting automotive business. While I personally am far more familiar with European and specifically German/French brands, it nonetheless comes with upsides that are worth considering – especially for the long term. Whenever a company becomes cheap that can be thought of as a market leader in one or more markets, it’s at least worth the question if the company has something it can offer you.

In Hyundai’s case, I do believe there’s value here, but administrative and practical challenges make this a hard one even for me.

Still, let’s see what we got here.

Looking at Hyundai

Hyundai Motor Company is a South Korean car manufacturer headquartered in the beautiful city of Seoul. Since its founding in 1967 by releasing the Hyundai Cortina in cooperation with Ford (F). The company began developing its own vehicles in the mid-70s with a British managing director who in turn hired some of the top car engineers in the industry, and the Hyundai Pony was released in -75.

The company has been in the European market since -82 and in NA since -84. It’s been through a couple of rough turns, including the shake-up in the Asian Financial Crisis of 1998, caused for Hyundai by overambitious expansion. That was also when Hyundai acquired the majority of its closest rival, Kia Motors (OTCPK:KIMTF). At the time, Hyundai owned more than 50% of the company. Kia is still part of the corporate structure known as the Hyundai Motor Group, which also includes Genesis and Ioniq, but its ownership stake is down to just north of 33% at this time. It’s a common misconception that Kia and Hyundai are the same manufacturers because of this – but they’re completely different automotive businesses, just under the same parent.

Hyundai has an annual production output of over 3.5M-4.5M units per year and 2021 sales of 3.9M vehicles, and revenues of 117T Won, or just south of $90B, making them one of the largest manufacturers around. On that 117T, they make around 6.7T worth of operating income, and 5.7T worth of net income.

Hyundai Motors is BBB+ rated, and as such is one of the best-rated automotives out there.

The ownership structure is pretty straightforward. There are government interests in the form of the largest public pension fund in the country, with 21.4% owned by Hyundai Mobis, the parts business, and a few percent owned by individuals known by the former CEO and the current “heir apparent” to the business, together about 7-8% worth of ownership.

Hyundai Motor Group is the second-largest chaebol in South Korea and manages 54 subsidiaries including businesses such as Hyundai Steel. These subsidiaries include what you get exposure to when you invest in Hyundai. A chaebol is essentially a Korean-specific conglomerate run by one individual or a specific family. Such organizations are less common in the west, but they are still very much around in South Korea and other areas, and they play a major role in both national politics and local trends.

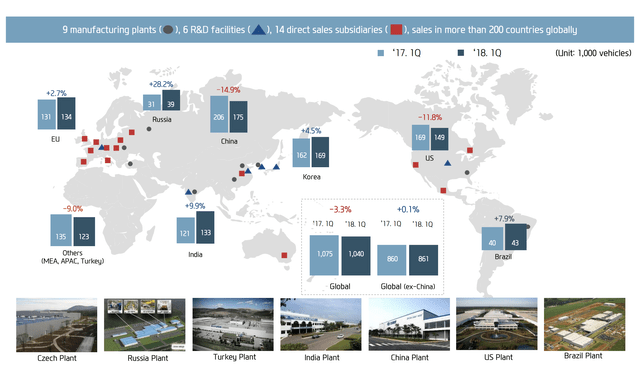

Back to Hyundai as a core. The automotive business has international representation with research, production, and sales subsidiaries across the entire world.

Hyundai IR (Hyundai IR)

The company has also, with the exception of the pandemic, seen successful growth in quality, vehicle dependability, and brand value growth since the culmination of the financial crisis. Since that time, the company ranks among the better non-premium brands, at #3rd place in vehicle dependability.

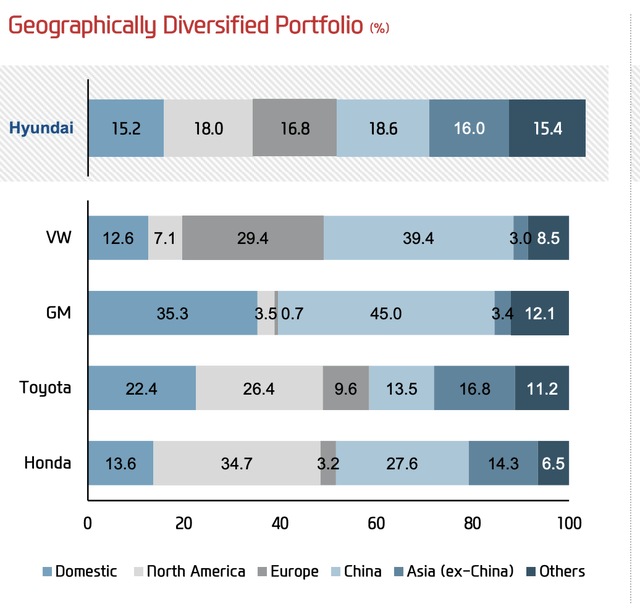

The company also has one of the best-diversified sales portfolios in the automotive world. Take a look at the mix here compared to its peers.

Hyundai IR (Hyundai IR)

Since its shift in dependability, the company has seen numerous awards and accolades come its way, and I believe it fair to say that the common perception of Hyundai, and Kia for that matter, is that they are quality products backed by long years of warranty usually unequaled by other manufacturers.

Like most businesses in the industry, Hyundai is on a path of streamlining and capturing efficiencies. EV will actually be a part of this, due to brand-wide platform integration, which will reduce future, if not current development costs and deliver a greater degree of scale economics. These integrations have the result of not only reducing development time for new models and model updates but improve company margins.

Like most automotive businesses, the company focuses on clean, connected, and free mobility. Its EV’s, Hybrids, and other new technologies are all on the market, and while I am not a Hyundai driver, I’ve tried their products and consider them to be qualitative for the consumers that want such a car. By 2025, the company wants to have more than 35 “green” models on the market.

The company has oft been criticized for its shareholder remuneration policy, which like most South Korean companies and chaebols has been focused on rewarding majority owners and the family/individuals as opposed to shareholders. Hyundai seeks to change this by allocating 30-50% of the company’s annual FCF to shareholder returns with combinations of buybacks and dividends.

Its stated target is to increase its payout ratio to be competitive on an international basis, and as an international investor, this is of course news that I welcome.

Mar

gins for the business are on par with other manufacturers and trend between 3-7% on net, but all of these trends are somewhat volatile with the pandemic. On a GM basis, the company goes between 15-20% gross margins, which again is in line with most major manufacturers – but it trends up and down.

2Q22 is the latest report we have. Sales saw a sequential increase of close to 19% and a YoY increase of 18.7%, with significant, recovering operating profit numbers, both sequentially and YoY, of 50-58%. The same is true for net profit. However, the company went very conservative with its dividend in 2021, dropping to a 26.3% payout ratio, well below its target and 2020 level. The dividend for 2021 was 5,000 KRW, and a current native share price of 196,000 KRW per share, which means a yield of less than 3%

Still, pushing aside dividend lag, the company has considerable upside and strength. The impact of higher product pricing and low spend/cost control outweighed the global issues of commodity pricing and labor cost increases. We should be very wary of the impact of these shifts, especially in a company like this, but the company posted much better results than overall expected due to impressive pricing power.

When digging down into the numbers for the quarter, we find that the company saw a negative EPS impact from raw materials and pressures from between 7-8%. However, this hasn’t done anything to completely offset the entire upside that the company sees from pricing. EPS visibility is, as I see it, high, and the company is forecasted to continue to grow its earnings.

EVs have also been relatively successful. The company, including KIA, has reached nearly a quarter million vehicles per year at the current run rate, and that’s excluding the Genesis brand from the mix. This ramp-up of EV sales has basically gone from zero-to-hundred in less than a few seconds. The release of its proprietary platform has enhanced sales here.

So how exactly does this flow to valuation for the company?

Let’s take a look.

Hyundai’s valuation

Similar to most automotive businesses, especially today (excepting premium brands like Ferrari (RACE) and similar), Hyundai has a tendency to trade at low earnings multiples. Over a 10-year period, the company’s average is no higher than 7X, with a maximum of 12X and a low of 4X. The company’s current normalized P/E is around 6.5X for the native share listed on the Seoul Index.

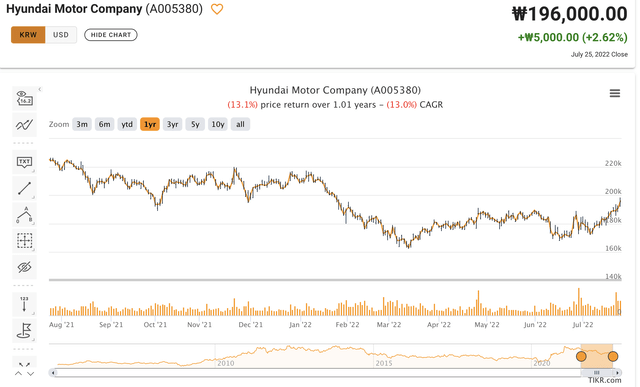

Profit multiples such as P/E, EBITDA, EBIT and similar metrics to revenue and market cap show us that Hyundai, following a price decline of 13% in a 1-year period, trades at an undervaluation – but that it is starting to recover.

Hyundai Price/Returns (Tikr.com)

Similarly, trailing multiples for the company show us similar undervaluations, with most of the usual metrics off around 10-30% to their 10-year historical averages. Considering the situation the company is currently in terms of sales, portfolio, and mix, it’s not an unfair assessment to make that Hyundai should trade somewhat higher even than some of its competitors.

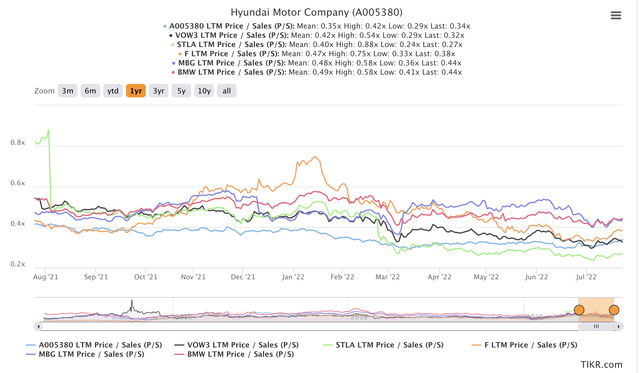

Hyundai is currently being “awarded” a 0.34X Sales multiple, for instance, and compare this to every major peer and there are certainly discrepancies there.

Hyundai peer valuations (TIKR.com)

These trends are fairly visible across the board of metrics – Hyundai is being discounted pretty heavily even to most of their closest peers. Some might call it a stretch to compare Hyundai to say, BMW (OTCPK:BMWYY). I say comparison to Porsche (OTCPK:POAHY) would be too far, but BMW is valid.

Forecasts for the company are equally positive. The bullish thesis here hinges on a continued ability to charge premium prices for good products – and I see the company being able to do this, especially with Genesis in the mix.

Overall, I, therefore, view Hyundai as undervalued – and I’m not the only one to do so. 27 analysts follow the company’s native ticker on the South Korean market, and 24 of them are at either a “BUY” or “Outperform” rating for this company. With an average price target of 257,000 KRW, the upside for the native ticker for this business is 31.5%. This is above the average for automotive undervaluation. The yield is of course, lower, but the safety for this company given its BBB+ credit rating is high.

Still, buying Hyundai is a relatively complex venture if you want the native. Even I have only limited access to the South Korean market, which leaves me with ADRs and similar avenues.

Hyundai’s ADR is HYMTF, and it’s relatively illiquid here on the US market. I found an avenue with telephone brokers to invest in the company natively, but it requires a steep minimum investment amount that I am currently unwilling to put down.

So while I currently do see the company as a “BUY” with a 15-20% upside, I also will not be investing in the company at this specific time.

Thesis

My thesis for Hyundai is as follows:

- Hyundai is perhaps one of the better automotive investments available due to its conservative nature and its home-field exposure to Asia, with an extremely well-diversified sales portfolio of attractive cars in every segment from semi-luxury to common.

- The company has a not-insignificant upside of 15-30%, and very few analysts currently following the company consider this anything except a “BUY” here.

- The relative complexity of making a “BUY” here means that I won’t invest a company until I see a sector-beating and absolutely massive upside with a great dividend. That time, for me, is not now.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion

/reversion.