“The stories of my death are greatly exaggerated.” – A phrase initially uttered by Mark Twain but also applicable to the perceptions of the recent freight industry.

A sharp and prolonged pullback of location sector rates, coupled with a surge in the value of diesel fuel, has sounded alarm throughout pockets of the business, but that problem has not nevertheless extensively tricked down to fleets, many of which are even now standing in line for new machines that truck and trailer OEMs only are unable to create quick more than enough.

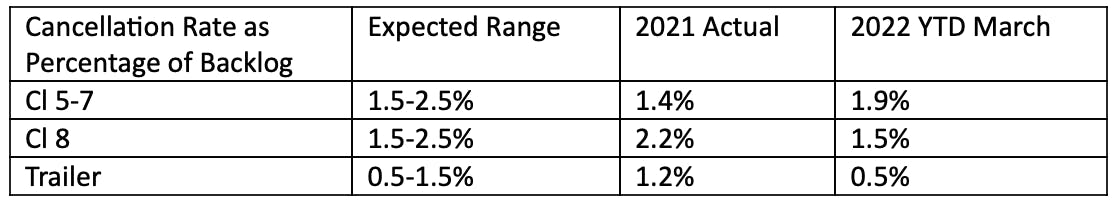

ACT Analysis Vice President Steve Tam explained just much more than 11,000 Course 8 truck orders have been canceled this calendar year as opposed to an buy intake of about 64,000 above the very first 3 months of 2022, and just beneath 4,000 trailers when compared to orders of more than 91,500. March’s trailer cancelations were the least expensive this calendar year, according to Tam, even though truck cancellations dropped 1,500 units from February highs.

“Although it may possibly not be completely obvious, cancellation activity is essentially a non-challenge,” Tam explained. “Most of the activity is truly the OEMs executing housekeeping – that is, cancelling orders for previous product yr products and changing the get with a corresponding new get. Merely place, need remains strong, not impacted by the current slowing freight expansion ecosystem. Freight is nevertheless developing, just at a slower rate. In the close to expression, the drop is from historic highs. Relative to the longer time period, growth remains intact.”

Source: ACT Research

Source: ACT Research

Fleets have been waiting to get sufficient new devices for in excess of a year, noted Don Ake, FTR’s vice president of professional motor vehicles. “To terminate and get out of the waiting around line at this level, with pent-up demand from customers so large, will not make a lot perception,” he stated, estimating pent-up demand for trailers by itself to be as superior as 100,000 models.

“Indeed, freight has eased off from the robust expansion we saw coming out of the economic restart, but freight volumes continue on to improve,” Ake extra. “FTR is forecasting Course 8 freight growth to continue being at healthy levels this calendar year and nonetheless be just underneath 3% next calendar year. Of system, there are risks to this forecast, and if the economic system finally goes into economic downturn, it would likely take the freight marketplaces with it.”

Ake added, when it truly is difficult to know correct truck and trailer cancellation figures simply because OEMs can terminate an existing get and re-enter it at a increased selling price because of to elevated product prices beneath the present-day disorders, “trailer cancellations quantities have been small for the final 3 months. Class 8 cancellation figures have been about common for the last three months.” Cancelations are averaged about a interval of 5 a long time.

Motor carriers not waiting for new assets are however paying historic premiums for applied sleepers and are doing so – sans some softening in demand for better mileage devices – devoid of hesitation. J.D. Electrical power Senior Analyst and Commercial Motor vehicles Product or service Manager Chris Visser mentioned that though fleets and lending institutions are using a much more “mature” look at of the industry, “there’s nevertheless a significant volume of freight to shift and a whole lot of consumers for employed vans. I question anyone’s producing key variations now, but this quarter will be pivotal.”

In the late 2018 down cycle in truckload prices, applied truck pricing took upwards of 8 months from the start off of the downturn to present large impression, Visser claimed, including that the recent freight and utilised truck trade cycle is nearly anything but regular “considering that trade is continue to greatly impacted by overseas shutdowns and the used truck cycle is nevertheless impacted by limited new truck availability,” he reported. “If freight quantity and charges continue on to decrease and we have much more new truck supply months like March, employed truck pricing will start moving far more notably. But people two things are much from confirmed. We’re mainly flying blind with very minimal historic standpoint to draw from.”

Robust financial indicators and optimism abound

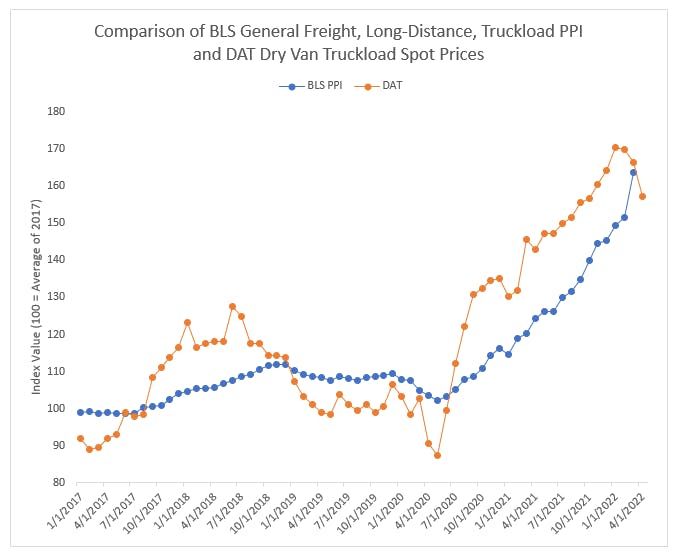

In the chart earlier mentioned, Jason Miller has transformed DAT’s headline (linehaul + surcharge) dry van level to an index and plotted it relative to the Bureau of Labor Statistics’ Producer Cost index for general freight trucking, prolonged-distance, truckload. “Be aware how we observed very immediate closure in excess of the earlier few months,” he explained. “Granted, the March reading from BLS may be revised greatly, but I imagine this assists describe why place freight is no extended as desirable as it when was. I significantly believe that this is the most essential component explaining the sharp fall in location prices.”

In the chart earlier mentioned, Jason Miller has transformed DAT’s headline (linehaul + surcharge) dry van level to an index and plotted it relative to the Bureau of Labor Statistics’ Producer Cost index for general freight trucking, prolonged-distance, truckload. “Be aware how we observed very immediate closure in excess of the earlier few months,” he explained. “Granted, the March reading from BLS may be revised greatly, but I imagine this assists describe why place freight is no extended as desirable as it when was. I significantly believe that this is the most essential component explaining the sharp fall in location prices.”

Asset acquisition apart, Jason Miller, PhD, affiliate professor of logistics in the Department of Source Chain Management at Michigan Condition University’s Eli Broad College or university of Business, mentioned there is a whole lot of basic power in the trucking industry’s underpinning. Miller pointed out that agreement prices have soared around the earlier handful of months, which subsequently clarifies – in aspect – the modern location industry pullback.

Credit history card paying, which achieved the most affordable place this calendar year in March, is trending on monitor to rebound in April, giving increase to optimism in the place industry going forward. The variety of hundreds posted to the DAT One particular load board network improved just about 7% during the week of April 17-23, the very first significant week-above-7 days raise in load availability since the end of February.

“It seems, at least based mostly on [U.S. Bureau of Economic Analysis] credit history card spending knowledge, that there was a pause for numerous sectors in the start of March 2022 that could have contributed to spot rates falling sharply at that place in time,” Miller said. “We are setting up to see the marketplace normalize, particularly on retail. We usually are not viewing pronounced 12 months-around-year gains in gross sales, and in most sectors of retail, at the time we take out inflation, revenue are now down from 2021,” but however way earlier mentioned 2019 amounts,” Miller included. “Illustrations include furniture and home furnishings sporting items, pastime, musical instrument and bookstore — sure, that is a actual industry category other normal merchandise and non-store retailing (e.g., pure-participate in e-retailers).”

Miller noted that shelling out cooled in the initial half of March (appropriate when oil charges exploded) but has because recovered. “When did place price ranges in trucking commence to steeply tumble? The very first two weeks of March,” he said. “I never feel this is absolutely a coincidence. My hunch is we noticed a pullback of some retail freight that brought on downward pricing pressure.”

The previous three months “have been a tale of the haves and have-nots” when it arrives to volum

e advancement, said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence, adding “load advancement could trend higher sequentially into May, supplying some support to location charges.”

Carriers without a doubt are optimistic about expansion in quantity and prices this calendar year, regardless of climbing gasoline and devices expenditures, according to the hottest Bloomberg/Truckstop.com study of small fleets and owner-operators.

About 72% of respondents count on load progress around the future 6 months compared to 71% to close out 2021 and the initial quarter a yr back. Temperature-managed carriers were being most optimistic with 77% expecting better volume, followed by 74% of flatbed carriers who are benefiting from a solid housing sector and infrastructure progress. There’s fewer optimism with regard to premiums. About 55% of respondents expect place fees (minus fuel surcharge) to climb in the next 6 months versus 59% in the fourth quarter of past yr. About 14% of carriers hope charges to decrease more than the following 3-6 6 months, in line with historic averages. Only 2% be expecting rates to fall speedily this year. One more 32% be expecting them to slowly and gradually moderate.

Premiums and loads usually are not even carriers’ prime concern. That crown goes to fuel. About 56% of carriers surveyed by Bloomberg and Truckstop.com said that bigger fuel prices are the industry’s most important obstacle. Lessen fees are the second-greatest problem in 2022 at 21% of the sample, followed by the weakening economic climate (16%). Regardless of these problems, about 69% of people surveyed foresee the truckload current market will stay tight this year, a good for carriers.